Tribal loans are issued by Native American or Indian tribal lenders that function on the reserve of their community. Tribal loans are frequently promoted as a credible substitute to payday loans for those in need of immediate funds. A payday loan is a form of short-term lending in which a creditor lends money at high-interest rates depending on the applicant’s earnings. Individuals who take out the best tribal installment loans generally have more flexibility in choosing financing options.

What are Tribal Installment Loans & How Do They Work?

Payday loans allow individuals who are unable to wait for their following income to arrive. Payday loans are generally short-term lending for amounts less than $1,000, as per the Consumer Financial Protection Bureau (CFPB).

Tribal payday loans are the viable alternative of payday loans provided by providers claiming to be based on tribe land rather than state-owned property. Even though applicants don’t have strong credit or a steady source of revenue, tribal loans will loan them a modest sum of money for a short period. Borrowers can meet critical expenditures amid paychecks by using cash from a tribal payday loan where debtors are required to return the loan once they are paid.

Types of Tribal Installment Loans Direct Lenders No Credit Check Alternatives

You can borrow the following types of tribal installment loans direct lenders no credit check alternatives through Heart Paydays.

Best Tribal Installment Loans Up to $5000 for Unemployed Individuals

Getting the best tribal installment loans can be challenging without a formal job, but it’s not impossible. Heart Paydays connects you to specialized lenders who offer some of the best tribal installment loans up to $5,000 for unemployed individuals. You only need to have an alternate source of income and prove affordability.

Tribal Installment Loans for Bad Credit Borrowers

If you’re worried that you can’t access quick loans because you have a less-than-perfect credit score, don’t be. Heart Paydays gives you free access to top lenders who offer tribal installment loans for bad credit borrowers with a single application. They’re suitable for people with inadequate or non-existent credit and are usually small and easy to repay.

Tribal Installment Loans Direct Lenders for Total Transparency

The last thing you want is to get into a loan deal with a lender or broker who may try to hoodwink you in the fine print. When you apply through Heart Paydays, your peace of mind and safety are guaranteed, and you’ll only be connected to transparent and trustworthy tribal installment loans direct lenders. They’re open about their fees, terms, and conditions, and you can easily find their contact information and reviews from previous borrowers.

Online Tribal Installment Loans for Low-Income Earners Processed Speedily

Heart Paydays gives you the ultimate convenience of borrowing quick funds online through a few simple clicks from the comfort of your home or office. You can access online tribal installment loans for low-income earners with fast processing speeds and quick disbursements. The application only takes a few minutes, and you’ll know whether or not you qualify within 2 minutes.

Tribal Installment Loans Guaranteed Approval Alternatives with Low APR Starting From 5.99%

Interest rates can easily make a loan expensive. With tribal installment loans guaranteed approval alternatives from lenders at Heart Paydays, you’ll get reasonable interest rates starting from 5.99% APR. You can get attractive rates that keep the loan affordable even with bad credit as the comprehensive panel of lenders at Heart Paydays compete with each other.

Tribal Installment Loans Direct Lenders No Credit Check Alternatives with Flexible Repayments

Through Heart Paydays, you can access tribal installment loans direct lenders no credit check alternatives with flexible repayment terms that make it easy to repay. You can choose a term from 3 to 24 months and make weekly, fortnightly, or monthly repayments depending on when you get paid.

Best Tribal Installment Loans Without Security

Some of the best tribal installment loans are unsecured, meaning you don’t need to provide any of your valuable assets as security for the loan. You’ll face low risk since the lender can’t repossess any of your assets and sell them to recover the loan if you default or fall behind on repayments. However, the lender will charge a higher interest rate than a secured loan to mitigate the risks involved.

Features of Tribal Installment Loans

Tribal loans are frequently for a limited period of time

Most tribal loans are structured as installment loans, rather than payday loans, which demand full payback when your following paycheck arrives. As a result, tribal loans generally have an extended repayment period than payday loans. However, unlike other types of individual installment loans, you are unlikely to be given years to repay the money you loan. Here the average loan period will be less than a year. These are high-cost credit options that aren’t for long-term financial needs.

The benefit of applying online

One does not however need to become a member of a tribe to request tribal installment loans. Usually, tribal creditors allow submissions online, regardless of the fact that you are a tribal member or not. Several tribal lenders even offer quick loan financing after the clearance process, with funds being put into your checking account that day or the following working day, depending on the policies followed by the lender.

Chances of high-interest rate

Tribal loans are sometimes more premium than payday loans due to regulatory issues. Payday loan companies frequently impose a $15 fee for a $100 credit, according to the Consumer Financial Protection Bureau. For a loan issued for two weeks, it translates to a nearly 400% rate of interest. Tribal loans may have higher interest rates; however, online brokers like the Heartpaydays.com offer APR rates range from 5.99% to 35.99% maximum APR.

Tribal loans are frequently for small sums of money

Despite the fact that certain tribal creditors may provide greater credit limits, it is usual to find advertisements for small loans. The agreements are usually offered for urgent requirements such as car maintenance or medical treatment and are in the $1,000 range.

Eligibility Criteria for Tribal Installment Loans

There are various conditions to qualify for tribal payday loans; while these rules are intended to be employed as a recommendation only, they may differ between different tribes. Applicants should study the policies of every creditor when applying for a loan. Many creditors may place a premium on your age, whereas others are more focused on your employment status. In the case of online brokers like Heartpaydays.com, customers must qualify the following criteria in order to apply:

- Applicant must be 18 of age or above

- He/she should have a valid and working email address

- The applicant must have a legitimate cell phone connection

- The debtor should be a bank account holder in the United States

Typical Costs of Tribal Installment Loans

- APR: According to the state legislature and the total amount you decided to borrow, this charge could vary from $10 to $30 per $100 loaned. In most cases, a charge of $15 per $100 is imposed. For a two-week borrowing, this converts to an approximately 400% annual percentage rate. Tribal installment loans are frequently used as a substitute for payday loans, where the APR on these loans ranges from 200 to 400 percent.

Heart Paydays offers APRs ranging from 5.99% to 35.99% from different lenders.

- Late payments fees: Based on state legislation, the creditor may impose a delayed or returning check penalty if you don’t pay back the loan on schedule.

If you’re thinking about taking out a tribal installment loan, be aware that you’ll encounter some difficulties, especially if you are unable to pay it back right away. Bankruptcy loan discharges, loan refinancing, and claiming your rights when the borrowing organization seeks payment are all such examples. Despite the fact that there have been no laws prohibiting debtors from being imprisoned, it is quite rare that an individual will be imprisoned if they are unable to repay their payday loan. The bulk of jail terms are for failing to appear before a judge or refusing to follow through on a prior court judgment on the matter, rather than for failing to pay the amount.

How to Apply For Tribal Installment Loans in Quick Steps

Step 1: Choose your loan amount

Determining the overall amount is probably the foremost concern when applying for a loan, regardless of the type of loan you are applying for. At Heart Paydays, applicants are generally eligible for loans up to $5000; however, the amount of the installment loan will differ based on which lender approves the application from their database.

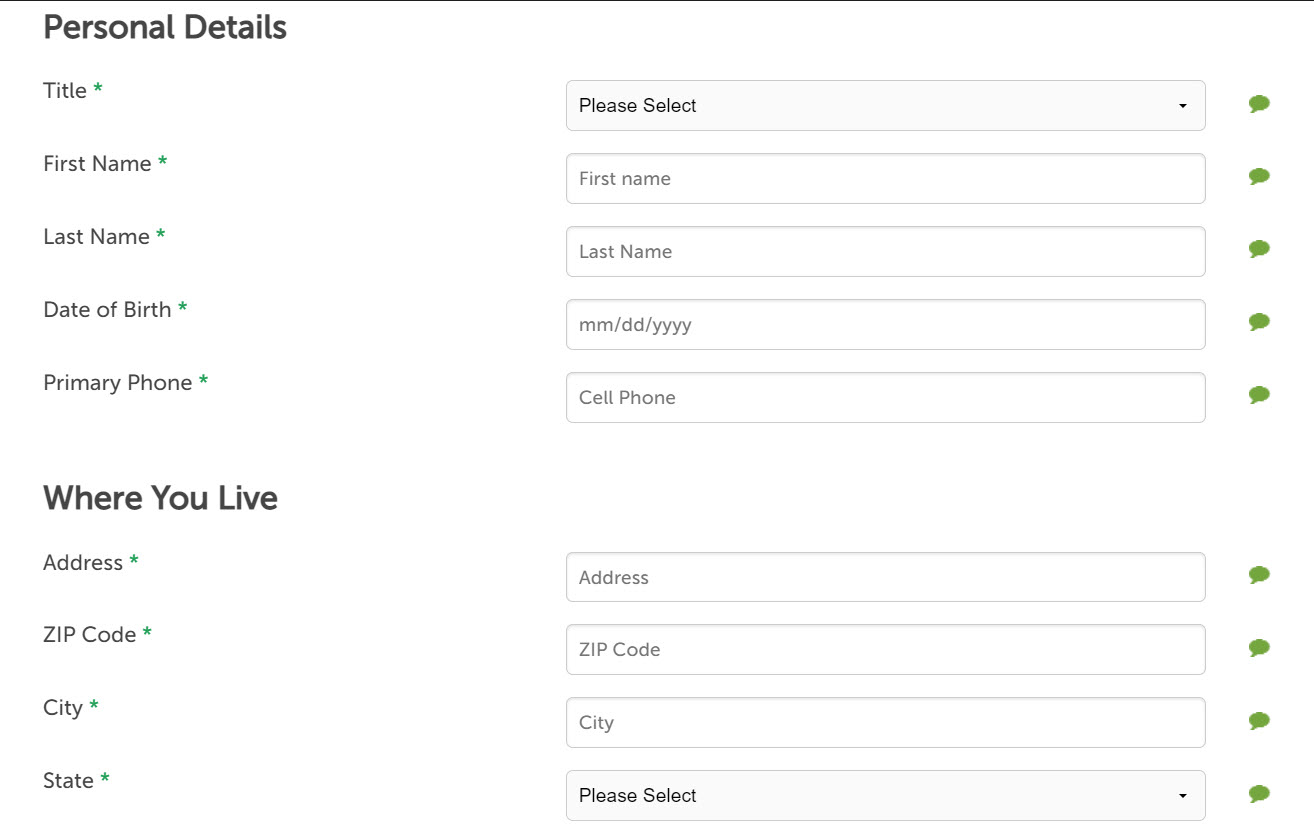

Step 2: Complete the application form

At heartpaydays.com, applicants may experience a seamless process while applying for the desired loan amount based on their requirements. As a borrower, you simply need to fill a short online form and opt for the required amount along with the term of the debt you are willing to borrow. This immediately starts the process of approving your request by a suitable lender.

Step 3: Wait for a decision

After you complete the online application, you will receive a response from a lender associated with heatpaydays.com that is appropriate for your credit requirements. Even though most credits are deposited to your bank the same day, it may often be dependent on your lender.

Step 4: Get your loan

Upon following the procedures mentioned above, the approval may depend on a lender to lender as well as the verification of your eligibility criteria and other documentation. In case your loan application is rejected, you will get the flexibility of using another brokerage or service to assist you in obtaining your loan.

How to find the best Tribal Installment Loans in the USA?

Tribal bad credit installment loans with guaranteed approval have many of the same advantages as regular payday loans. Both would, in essence, lend debtors a modest sum of credit for a brief period, even if they do not have strong credit or a steady means of revenue.

Considering tribal installment loans from direct lenders has the drawback of requiring you to contact each lender separately. There seem to be no intermediaries that will request to collect your paperwork and analyze your financial situation while working with direct lenders. The clearance of your application is also a disadvantage as direct lenders choose their own lending conditions and application criteria. A broker such as Heatpaydays.com can help a customer minimize their fees and save your effort when it comes to applying for a mortgage or approaching a prospective lender.

Conclusion

Brokers tend to be more beneficial in terms of saving time and effort when taking out tribal installment loans from direct lenders with no credit check. At heartpaydays.com, you can get access to various lenders as per your requirements as well as a comprehensive platform that takes care of all the necessary procedures to approve a loan with no credit check.

FAQs

Do tribal loans check credit?

No, you can get a tribal loan even without acquiring strong credit history.

What happens if you don’t pay back a tribal loan?

If you default on your obligation, a tribal loan lending provider might sue you in court. This type of scenario only occurs when you are behind on your repayments and in breach of your loan contract.

Are tribal loans bad?

Since tribal payday loans may not necessarily follow federal or state rules, they might appeal to a broader segment of the community. As a consequence, they may typically provide more credit than regular payday loans that can be used in urgent financial crises.

Is a credit check required for an installment loan?

Although most lenders need a credit check to apply for traditional loans, there are many lenders who provide installment loans for those with low credit.

Are tribal loans illegal?

Tribal payday loans aren’t exactly illegal. To be clear, providing loans while being on tribal property is perfectly legal, but that doesn’t mean you get tribe immunity or may ignore federal or state laws.

What happens if I close my bank account and default on an installment loan?

In case the lender cannot obtain your new account details, they’ll go into collection, get a court order, and a Paycheck attachment where you must follow what the court has ordered.