It would be easy to afford all our expenses, even the unexpected ones, in a perfect world, right? Luckily, the average American has had access to instant funding installment loans to help them bridge the gap from one paycheck to the next. So if you find yourself a little short on cash, don’t worry – it’s not the end of the world. The truth is that it happens to most people, and with instant funding installment loans online quickly and easily available, many Americans get to cover their financial shortfalls with ease and get back on their financial feet again.

That said, this overview takes a closer look at the same day instant funding installment loans available to you in the US. It also features information on what types of instant funding installment loans you can apply for, the criteria and eligibility to apply for one, and the steps to apply for installment loans instant funding for you. Let’s dig in!

What Are Instant Funding Installment Loans In The US & How Do They Work?

Instant funding installment loans have saved the day for many Americans in a tight financial spot. By nature, instant funding installment loans are small loans that are paid out fairly quickly and repaid by the borrower over a set time. If you get an instant funding loan, you must be sure to make the monthly payments, or you could be faced with penalties. Thanks to the automated system at Heart Paydays, the loan model is simple. It’s surprisingly easy to apply for instant funding installment loans bad credit online in a matter of minutes.

All you have to do is choose how much you wish to loan. The amounts available range from $100 to $5000. Once you’ve selected the loan amount, you can select the repayment period, which ranges from 3 to 24 months. When submitting your requirements, you will be presented with a possible installment amount, and if you wish to proceed, you will need to complete the online application. Applying for instant funding installment loans online via Heartpaydays.com only requires you to complete one application form that will take a few moments of your time. Then, at the top right-hand side of the screen, click “Apply” and follow the prompts. The online application is required to capture all of your details so that the lender can decide if you’re eligible for a loan and how much you’re able to borrow. Read on to learn more about the various types of installment loans instant funding you can apply for on Heartpaydays.com.

Types of Instant Funding Installment Loans

Everyone is unique and much the same; there are several unique options to choose from when it comes to instant funding installment loans online. For example, there are instant funding installment loans for bad credit, same day instant funding installment loans, and more! Below is a list of the types of instant funding installment loans you can access online:

Instant Funding Installment Loans for Bad Credit

If you’ve had a problem with your credit score in the past, you may hold off from applying for instant funding installment loans. It’s good to note that you can use instant funding installment loans bad credit to rebuild your credit by taking out small loan amounts and repaying the loans on time and in full.

When using the Heart Paydays loan-finder service, your credit will not be checked by Heartpaydays.com. Still, the lenders on the panel may carry out a credit check and verify other eligibility criteria before they can approve instant funding installment loans online.

Instant Funding Employment Loans For Unemployed Individuals

If you aren’t employed traditionally, you may find that instant funding installment loans are still available to you if you meet the minimum earning requirements through other means. Other acceptable forms of income include rental income on properties, investment dividends, trust payments, allowances, government benefits, and similar. While you won’t have a pay slip or stub to present as proof of income, you can use your bank statements, income statements, and tax returns as proof of income. This means that instant funding installment loans are available to those who aren’t employed traditionally.

Unsecured Instant Funding Installment Loans

Most instant funding installment loans are unsecured. This means that you don’t need to offer up your property, car, jewelry, or other assets to get the loan. Unsecured instant funding installment loans online don’t require collateral and won’t require someone to sign surety on the loan. On the Heartpaydays.com site, you will find several lenders willing to provide eligible applicants with installment loans instant funding. The available unsecured loans range from $100 to $5000, and depending on how much you borrow, you can pay it back over 3 to 24 months. Lenders consider unsecured installment loans instant funding risky, and because of this, they charge borrowers high interest. In the case of lenders on the Heart Paydays panel, you can expect interest between 5.99% to 35.99%.

Same Day Instant Funding Installment Loans

Isn’t it great news that you can apply for a loan today and get the money in your account by tomorrow? This is the nature of instant funding installment loans. When using the Heart Paydays loan-finder service, you can expect to get access to lenders that are known for quick disbursements. In most instances, loans are paid out within 60 minutes of approval, even though the standard is set for 24-hour turnarounds. The same day instant funding installment loans range from $100 to $5000 with 3 to 24 months to pay and interest of between 5.99% and 35.99%.

Features Of Instant Funding Installment Loans

What can you expect from installment loans instant funding? Most instant funding installment loans online via Heart Paydays have the following features in common:

Quick & Easy Online Application

If you’re keen to apply for instant funding installment loans bad credit online, you’re in luck because that’s how Heartpaydays.com works. Everything is handled online, which means you don’t need to make a special trip to a storefront, stand in a queue or make a telephone call. Simply fill out the application form with the Heart Paydays loan finder service using your internet-connected laptop, mobile phone, iPad, or desktop computer. Once the form is submitted, wait two minutes to get feedback on your loan outcome. Digital convenience saves time and effort.

Cash In Your Account On The Same Day

If you think you will have to wait days to get the cash paid into your account if you get approved for the instant funding installment loans you apply for, you’re wrong! When applying for instant funding installment loans online, the application process takes just a few moments, and the approval process takes only two further minutes. If the loan is approved, the cash can be paid within 60 minutes. This isn’t 100% guaranteed. If there is a delay, borrowers don’t often wait longer than 24 hours to get the cash from their approved installment loans instant funding.

Reasonable Interest Rates

By now, you’re probably aware that online loans that are not provided by the local bank typically come with hefty interest attached. Of course, where you get your loan from plays a role. When using some instant funding companies, interest can be as much as 400% or more. When applying for instant funding installment loans via the Heartpaydays.com portal, you can expect interest rates to range from 5.99% to 35.99%. If you feel that the interest rate on offer is high, don’t be afraid to ask the lender to consider a lower interest rate. Many are competitive and you might just be lucky enough to get a lower interest rate on request.

Instant Funding Installment Loans Via Heartpaydays.com

Before applying for installment loans instant funding, take the time to do a bit of research into what to expect. Below, there are a few examples of instant funding installment loans, to help you determine if these loans are suitable for your budget. These loan examples are from the Heartpaydays.com loan-finding service:

| Lender | APR | Loan Amount | Min Credit Score | Funding Time |

| LendUp | 30.00 – 180.00% | $100 – $500 | None | 24 hours |

| CashNetUSA | 89% – 449% | $300 – $3,500 | Not Specified | 7 business days |

| Avant | 9.95% to 35.99% | $2,000 to $35,000 | 580 | 24 hours |

| Rise Credit | 50.00 – 299.00% | $500 – $5,000 | None | 24 hours |

These are just examples and are subject to change.

Advantages And Disadvantages Of Instant Funding Installment Loans

The following advantages and disadvantages can be expected when it comes to personal loans installment options:

Advantages of Funding Installment Loans

Almost-Instant Payout

It can be a genuine relief when you need cash in a hurry, and a lender makes it possible by paying out your loan on the same day you apply for it. That’s the type of service you can expect at Heart Paydays. While Heartpaydays.com doesn’t pay out loans directly, the lenders they link you with might. And the good news is that most of them offer 60-minute payouts from approval, or at most, 24-hour payouts.

Private And Discreet Lending

One of the perks of applying for instant funding installment loans online is that your application is handled with absolute discretion. Nobody wants other people to know they are going through tough financial times, especially if you’re applying for instant funding installment loans bad credit. Because you can apply for your loan online, there’s also no need to worry about being embarrassed if your loan request is turned down.

Minimum Earning Of Just $1000/PM

To get approved for instant funding installment loans, you don’t have to be earning a fortune. You need to earn a steady income, of course, and the minimum is set at $1000 per month. While there’s an earning minimum required to make you eligible, you don’t need to have a traditional job. You can earn your income through property rentals, dividends, freelance profits, and similar.

Disadvantages Of Instant Funding Installment Loans

A Costly Form Of Borrowing

There’s no denying that instant funding installment loans bad credit available online are convenient, especially for those who have been unable to acquire a loan through the local bank. That said, convenience nowadays comes at a cost, and in the case of instant funding installment loans, the cost is high interest ranging from 5.99% to 35.99%. As such, same day instant funding installment loans are considered an expensive form of borrowing.

Are You Eligible For Instant Funding Installment Loans?

There’s no denying that it’s quick and easy to get instant funding installment loans and installment loans instant funding when using a loan-finder service such as Heart Paydays. While that is the case, applicants must still meet certain requirements in order to qualify for same day instant funding installment loans. The eligibility requirements are as follows:

- Minimum of 18 years of age for applicants

- Applicants must be a US citizens or legal residents

- Have a valid form of ID and provide your social security number

- Provide proof of address

- Borrowers must earn at least $1000 per month

- Supply supporting documentation: bank statements (3 months) pay stubs (3 months)

- Have your own active bank account and active US mobile number

Apply For Instant Funding Installment Loans Online In Four Easy Steps

The application process for instant funding installment loans online via Heartpaydays.com is absolutely simple and won’t take very long at all. With the Heart Paydays loan-finder service, you will be linked to lenders able to assist you. Below are four simple steps you should follow to apply for affordable instant funding installment loans online.

Step 1: Select The Loan Amount

It’s vitally important to ensure that you can afford to repay the loan you’re granted, so spend a bit of time taking a close look at your budget. Understand what you can afford and what you can’t. Then, select how much you wish to borrow and input the requested repayment terms. Loans range from $100 to $5000 on the Heartpaydays.com portal. The repayment terms also range from 5.99% to 35.99%. Once you’ve selected the loan amount, the system will present you with a potential monthly installment to consider. This is just an estimation as the final installment is based on your information.

Step 2: Spend A Few Moments Completing The Online Application

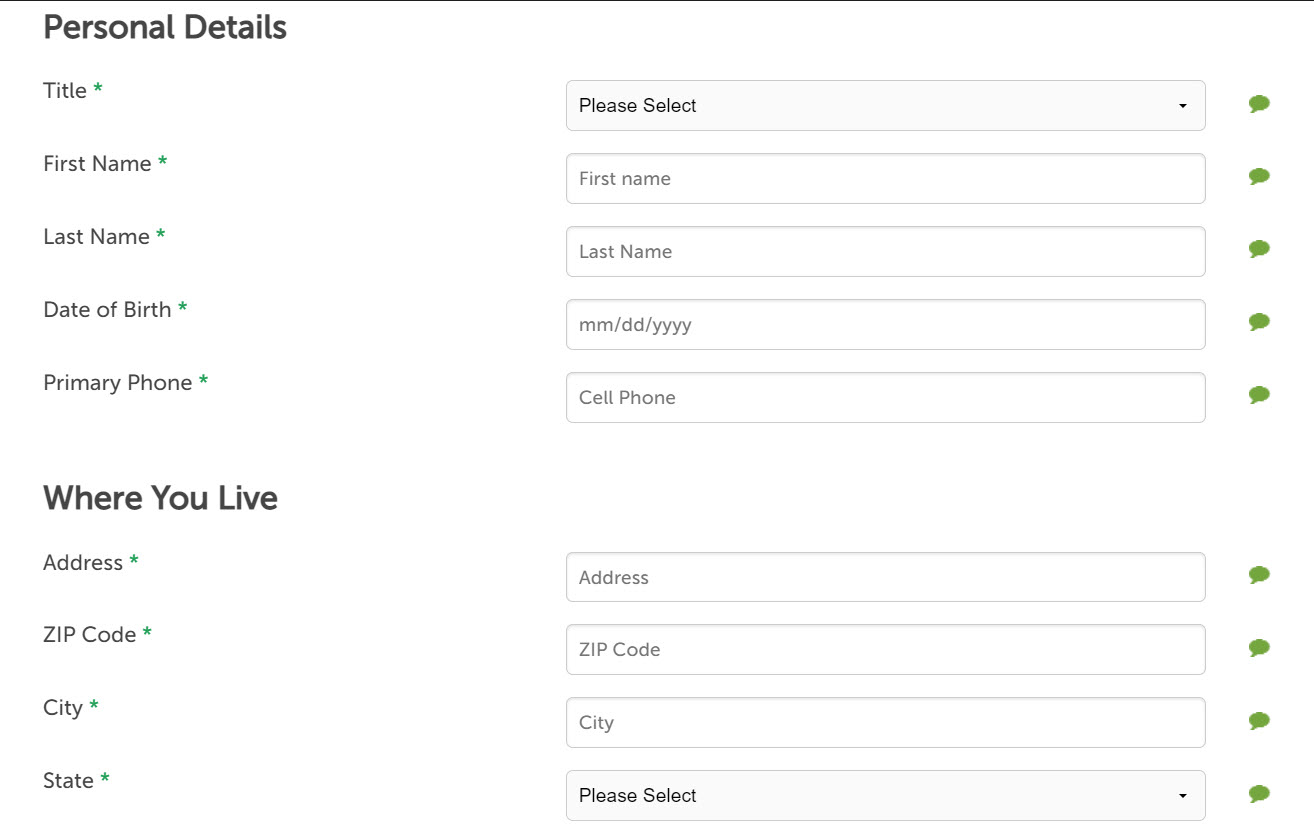

There’s no need to print out an application and fill it out. Instead, the application form is digital and hosted online. Click on “Apply,” which is on the top right -and side of your screen. Then, spend time working through the sections on the form. This will require your full name and surname, contact details, address, banking details, employer details, and a list of your current expenses. Being accurate will mean that your instant funding installment loans application can be processed smoothly and quickly. Be aware that lenders will verify the supplied information, so honesty is undoubtedly the best policy here.

Step 3: Get A Loan Outcome Within 2 Minutes

Waiting around is no longer the way to go when it comes to loan applications. Instead, we live in a time of instant gratification, and it’s the same when it comes to instant funding installment loans online. When you make your application, the automated system will connect you with lenders most likely to assist you. These are pre-approvals that are subject to further lender checks and verifications. Two minutes is all it takes for pre-approval. If you aren’t matched with a lender, you will be provided with notice thereof, and we can always provide advice on credit repair and debt consolidation. When you’re put in touch with potential lenders, they may do a credit check and request further supporting documentation.

Step 4: Get Your Loan Contract & Get Your Cash!

In the next step, the lender will present you with a loan contract. You must read through the agreement terms and conditions and ask as many questions as possible. Only sign the loan agreement once you’re happy with the details. You can sign the loan agreement digitally, which is most convenient! Once the deal is signed and the lender has checked it, the online personal installment loans provider will activate the loan and ensure that the cash is paid into your bank account. Payments usually take around 60 minutes from the loan being approved, but sometimes this can take a little longer – usually by the next business day.

FAQ’s

How Can I Get A Loan Online Immediately?

Instead of applying for loans with the local bank, apply for loans through Heart Paydays where lenders endeavor to offer quick turnarounds on loan applications and disbursements.

Can I Get Instant Funding Installment Loans With Bad Credit?

Yes, you can. Some instant funding installment loans are provided with the intention of helping bad credit borrowers improve their credit scores. That said, some lenders will help individuals with a low credit score but will consider additional factors such as their income, cash flow, and current employment.

What Type Of Instant Funding Installment Loans Are There?

Instant funding installment loans come in various shapes and sizes. The most common include same day loans, payday loans, unsecured loans, loans for bad credit, and instant cash loans.

Are Instant Funding Installment Loans Online Safe?

It is generally safe to get an online loan if you choose a reputable lender to work with. You should consider it a red flag if the interest rate is higher than 35.99% or if the lender guarantees loans without credit checks. By using a loan-finder such as Heart Paydays, you can rest assured that you have access to reputable and ethical lenders. By using a loan-finder you can avoid becoming a victim of a predatory loan which usually ends in a debt trap.

How Much Do I Have To Earn If I Want To Apply For Instant Funding Installment Loans?

To qualify for instant funding loans online, you must earn a monthly minimum of at least $1000. You don’t have to get this income from an employer. You can earn your income through several means such as property rental, dividends, allowances, child support, government benefits, and more.

What Can I Use Instant Funding Installment Loans For?

When getting an instant funding installment loan, you can use it for whatever you need to. The lender will not expect you to provide finite details on your plans. Most people use instant funding to pay for unexpected and emergency expenses or to cover hefty expenses when they don’t want to max out their credit card.

Can I Get Instant Funding Installment Loans With A Low Income?

How much you can borrow really depends on how much you earn each month. If you earn on the lower end of the scale, it is better to keep your loan request as small as possible, or the lender will determine that you cannot afford the loan and may turn your request down. That said, if you’re using the Heart Paydays portal, you need to earn a minimum of $1000 per month.

How Quickly Do Instant Funding Installment Loans Need To Be Repaid?

The lenders that are on the Heartpaydays.com panel offer loan repayment terms that range from 3 to 24 months. This means that you can negotiate a repayment schedule directly with the lender (one that works for both of you). Repayments can be made by direct debit fortnightly or monthly.

Can I Get A Loan In 10 Minutes?

If you’re looking to get a cash loan in a hurry, you might feel desperate enough to accept loan offers from predatory lenders. The good news is that you don’t have to! You can get a loan approved in just a few minutes and paid out on the same day. Simply use the loan-finder service at Heartpaydays.com, and connect with lenders most likely to assist you.