The short-term, small-dollar credit marketplace in the United States has changed dramatically in the last two decades. Bad credit loans which are a new form of installment loans mainly serve credit-challenged individuals, generating this revenue from online applications. Most installment loan lenders comply with state and federal interest rate caps and loan terms. However, a new class of online lenders has started to claim that they are exempt from the law citing tribal sovereign immunity as the reason.

What are Tribal Installment Loans Direct Lenders No Credit Check & How Do They Work?

Tribal installment loans from direct lenders with no credit checks are loans provided by lenders belonging to Native American tribes. Tribal installment loan lenders have immunity that allows them to operate internet-based lending businesses in certain states. The proponents and backers of these types of loans argue that the existing barriers to economic growth create the need for such products. There are currently about 11 federally recognized tribes that are affiliated with bad credit loans.

People tend to confuse the terms payday loan with tribal lending. However, that’s not the case as tribal loans are more like installment loans. Native American lenders offer more flexible repayment plans that are more secure even though their APRs are high. Structurally they are similar to conventional loans which involve the borrower paying a small portion of the loaned amount along with interest after a given period. This makes it easier for individuals to budget on repayments, rather than requiring them to pay a lump sum amount.

Tribal installment loans with no credit checks which come from registered lenders are usually safe. This does not mean that the borrowers will qualify for the same rate as one with a better credit score. These loans carry with them high-interest rates and are exempt from most laws. This makes it more important to select the right lender as the government will have no authority to do anything in the event of disputes.

Features of Tribal Installment Loans

As mentioned before, the essential features of tribal installment loans are the same as installment loans for bad credit.

- More chances of success

Tribal loans for bad credit do not judge an applicant by their credit score as opposed to traditional loans. This increases the chances of getting the loan which comes as a blessing for many families struggling with bad credit. Signing up with a broker like Heartpaydays.com even further increases the chances of success.

- Can be easily applied

One of the reasons why these forms of loans have become popular is their convenience. This is because traditional banks and financial institutions often require individuals to provide several documents which require a lot of paperwork. Traditional credit institutions also take a lot of time to conduct their credit checks and evaluate every application individually. On the other hand, tribal installment loans from direct lenders and brokers offer guaranteed loans without the hassle. The loan amount generally gets credited within days of applying.

- Clearly defined terms and conditions

Reliable tribal lenders normally provide clear-cut rules when it comes to providing loans. These are usually clearly stated in their privacy policy and terms and conditions. It gives the applicant a clear idea about how much interest they would have to pay so that they can plan accordingly. Depending on the terms, many lenders may even allow the borrowers to pay back the loan before the stipulated loan repayment schedule.

Eligibility Criteria for Tribal Installment Loans

Tribal loans can be accessed by almost all United States citizens. As it is a form of bad credit loans, the requirements are generally less which allows a greater number of people access to its services. Normally, brokers such as Heartpaydays.com make it very simple and easy to apply through an online portal. It has some basic requirements as listed below.

- Applicants at Heartpaydays.com have to be at least 18 years of age.

- Applicants at Heartpaydays.com must be holders of valid US bank accounts

- Applicants at Heartpaydays.com must provide a valid email address and phone number.

The process of getting a loan granted depends on the numerous lenders under the broker’s network who will then go over the application and judge its credentials.

Some other tribal lenders require some other requirements that may apply based on the stage. These include:

- The applicant must have a driver’s permit.

- He/she should offer proof of yearly or monthly earnings.

- Lenders may require borrowers to sign additional clauses.

Typical Costs of Tribal Installment Loans

The tribal loan can be more expensive than a normal installment loan due to disagreements about regulations. It’s common to encounter lenders which charge a high fee of $5 for a loan of $100. Tribal installment loans from direct lenders with no credit check for unemployed people involve high interest as well because of the amount of risk that each lender takes in. The APR of the average percentage rate takes into account interest and the costs associated with the loan.

Some of the other associated fees include loan origination fees, application fees, and hefty late payment fees. Late payment fees can be especially a major strain on one’s finances if he/she doesn’t plan out their budget properly. In the case of heartpaydays.com, they work with lenders with APRs ranging from 5.99% to 35.99%.

How to Apply Loans for Tribal Installment Loans Direct Lenders No Credit Check in Quick Steps

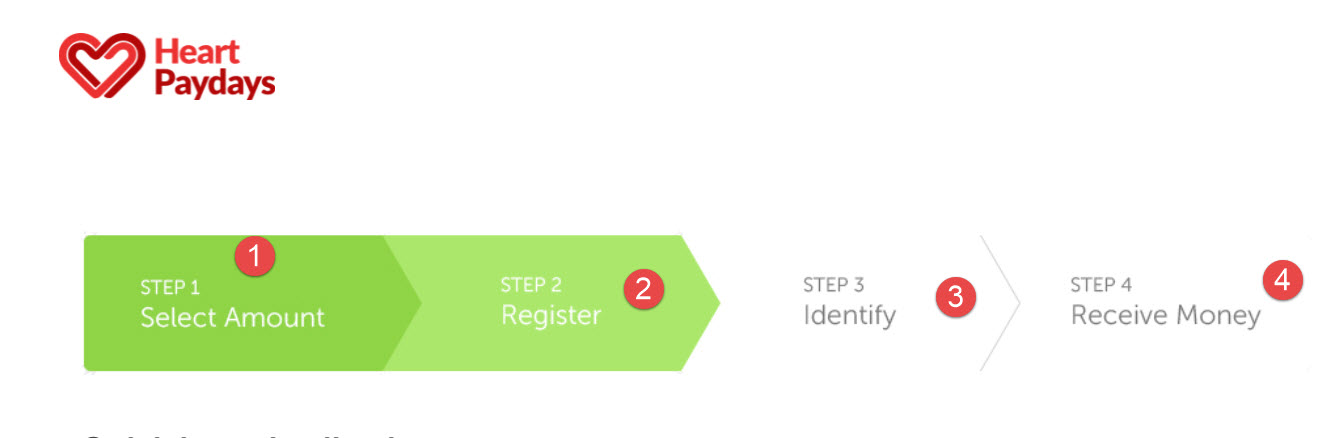

At Heartpaydays.com, the process of applying for a loan is pretty simple and easily understandable. All one has to do is follow the simple 4 step loan application process to get their loan granted on time.

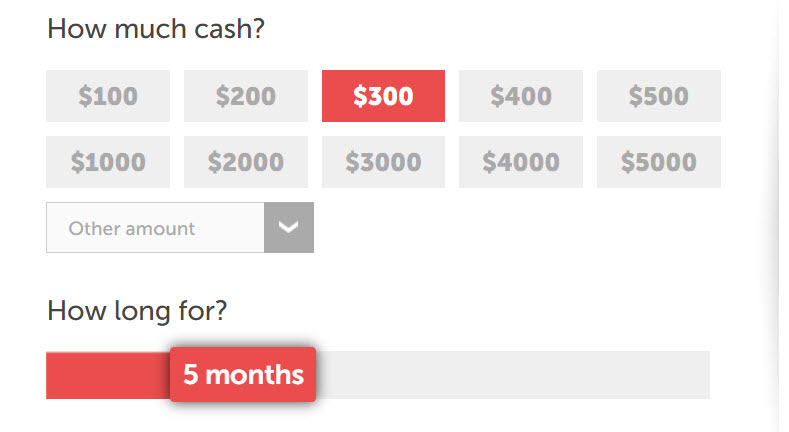

- Deciding on the amount to request from lenders

At Heart Paydays, borrowers can apply for a single loan of up to $5000. They should always have a concrete plan of how much they require to relieve the financial stress. Requesting more than this can put unnecessary strain on one’s finances.

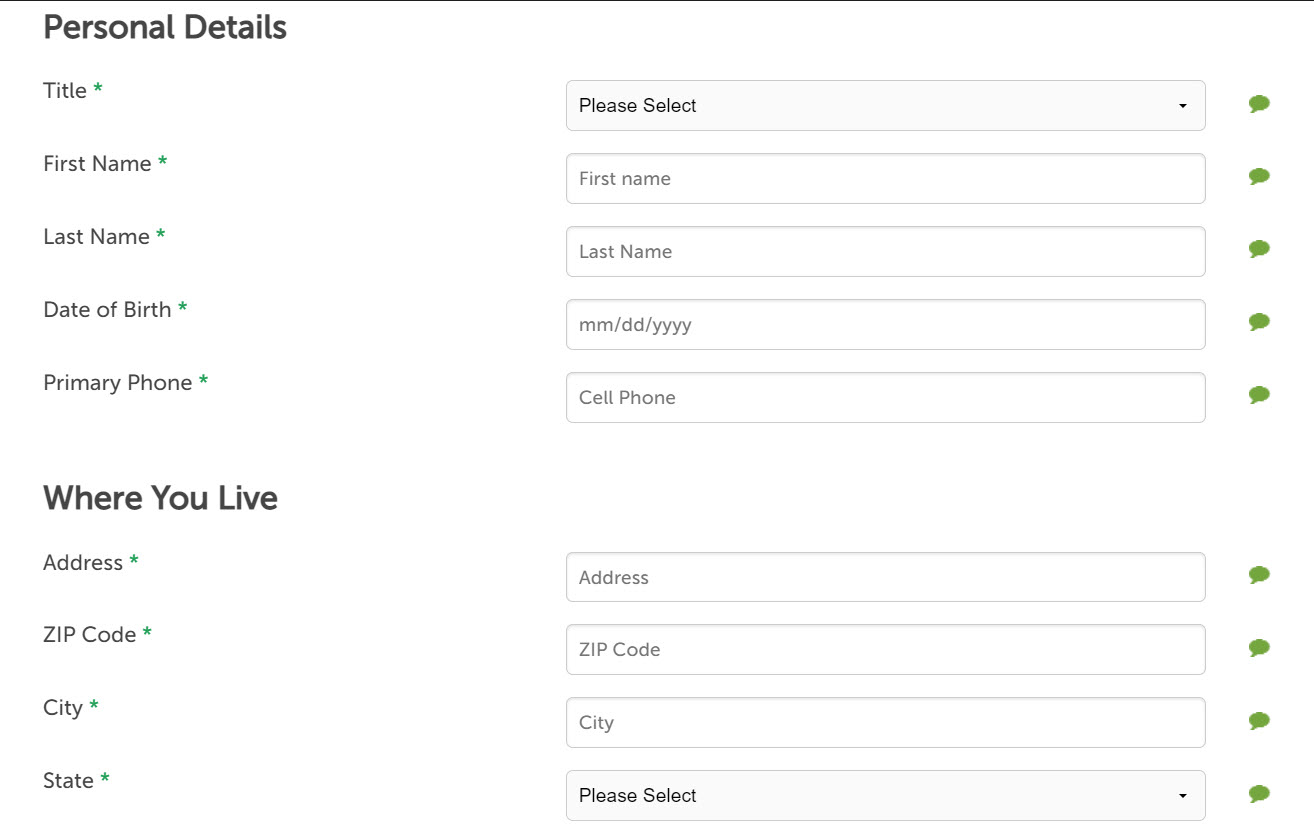

- Filling the form properly

Heartpaydays.com provides a form that can be filled in mere minutes. Borrowers have to simply specify their desired amount as well as their preferred fee and repayment schedule.

- Waiting for approval

Heartpaydays.com reviews the applications when they are submitted and connects them to appropriate lenders that can provide the respective loan services to them. Unlike other brokers, Hertpaydays.com itself does not conduct any credit checks. The applicant however can be subject to credit checks from third-party credit checking services by the lenders.

- Receiving the loan

After the lenders under the broker’s network have conducted all their checks, Heartpaydays.com will send a notification to the borrower informing them that the loan has been accepted. The loan amount can be sent to the borrower’s account in one to five days from the date of application.

How to find the best Tribal Installment Loans in the USA?

Tribal lenders are generally immune from state regulations and other laws. They are entitled to receive immunity under the doctrine of tribal sovereign immunity in the United States. Many tribal lenders have been operating successful loan schemes which are in line with the policies and legal framework of tribal immunity. There are also some non-tribal lenders that attempt to grant loans under the guise of the sovereignty laws in an effort to evade jail time. While some lenders practice a predatory business model, there are others that offer a welcomed temporary solution to one’s financial woes.

Choosing a broker like heartpaydays.com allows the borrower can help borrowers avoid the hassle of searching for different lenders. Through its platform, Heartpaydays.com can help applicants navigate the complex landscape of installment loans for bad credit. These brokers usually have more knowledge of the credit market as opposed to individual lenders.

At Heartpaydays.com, one can get access to its huge network of lenders which will allow them to get better loan rates. It also prevents any applicant from falling into a trap laid down by unscrupulous lenders in the market. Success rates are also increased by many folds.

Conclusion

Guaranteed tribal loans and other forms of bad credit installment loans are great for people that are unable to get credit from banks. With conventional creditors, they would have to wait for several days or weeks to get the loan application accepted. However, the instantaneous nature of such loans is what attracts most people towards bad credit loans. Borrowers should take great care to not apply for an amount of loan that they would themselves struggle to pay back. This is one of the reasons why many people get caught in a vicious cycle of poverty. At heartpaydays.com, one easily gets short-term relief by applying for an installment loan.

FAQs

Do tribal loans check credit?

Installment loans from tribal lenders usually do not have stringent requirements for credit scores and hence do not undertake any credit checks. This is why they appeal to a wider section of the population as they do not adhere to state and federal laws. They offset this risk by charging high APRs of upwards of 20% in some cases.

What happens if you don’t pay back a tribal loan?

Because of the complex rules and regulations surrounding tribal loans, it becomes a complex issue when the borrower fails to return the loan amount on time. The lender might employ debt collectors that may try to take the individual to court and force them to pay. If the individual doesn’t dispute the claim or lawsuit or if the ruling falls in the lender’s favor, the lender may be able to garnish the individual’s wages.

Are tribal loans bad?

Tribal loans are generally considered a very expensive and high-risk credit accessing method. But individuals in sticky credit situations may find tribal loans as the only answer. There are also other lenders that offer installment loans for bad credit which are less risky than tribal loans. These types of loans should only be considered when one has exhausted all conventional and available forms of accessing credit.

Is a credit check required for an installment loan?

Lenders that offer installment loans for bad credit usually do not check the credit ratings of their applicants. This is because these financial products were designed for less creditworthy individuals who have been turned down by traditional banks. Some lenders may conduct a credit check, but their requirements for a loan getting approved are much less.

Are tribal loans illegal?

Tribal lenders used the premise of tribal sovereign immunity to protect them from lawsuits when these types of loans first came into prominence. Tribal sovereign immunity allows these lenders special privileges that can lead them to govern themselves. However, in recent years, the government has put forward some frameworks to regulate the business. Many of their token practices continue to be technically illegal even if the loans aren’t. The simple fact that these lenders have gone out of their way to place themselves beyond the jurisdiction of state and federal laws demonstrates that they cannot be easily trusted.

This is why it’s best to look elsewhere and search for brokers that provide multiple options of accessing credit when one has a bad credit score. These lenders often layout clearly stated terms and conditions which make the repayment experience better.

What happens if I close my bank account and default on an installment loan?

Several things can happen when one closes their bank account and defaults on an installment loan. In case one fails to repay the loan back on time, their records might be sent to an assortment organization, hurting their credit. Failure to pay the loan back in time can also result in bank overdraft expenses, a steady assortment of disturbing calls, and legal trouble.

In certain cases, the lender will attempt to gather the installment from the borrower within 60 days. They can hire the services of an outsider obligation assortment company in case the borrower can’t pay them within this period. These companies can call and send letters to the borrowers consistently till they get the cash as their assortment endeavors are more forceful.