If only the world worked in such a way that you’d earn enough to cover even emergency or unexpected expenses, right? The reality is that personal installment loans have been keeping Americans going financially for decades. And that’s because life happens and so do financial shortfalls. But with personal installment loans online so readily available, we can count our lucky stars that these shortfalls can be temporary, allowing us to get back on our feet and be financially comfortable once more!

That said, this overview takes a closer look at the online personal installment loans available across the US. It also focuses on what they are, how they work, the types you can apply for, features, eligibility criteria, and finally, the steps you can follow to apply for the right personal installment loans for you.

What Are Personal Installment Loans Near Me & How Do They Work?

Personal installment loans are a lifesaver for those in a financial pickle. They’re designed to be mid-range loan amounts repaid in monthly installments over a certain time. The installments are usually fixed, and there’s a specific agreed-on end date. If the borrower defaults on payments, there will be penalties incurred, and you could have a tarnished credit record. On the other hand, the loan model works fairly simply, especially if you’re applying for installment personal loans via the Heart Paydays portal.

Simply select the loan amount you require, which ranges from $100 to $5000 with 3 to 24 months to pay. You will be presented with the expected installment – this is just an approximate amount – keep in mind this can vary from one lender to the next, so consider it a ballpark. Next, you need to apply. Personal online loans with installment payments are simple to apply for on Heart Paydays’ website. Look to the top right of the screen, and you will see a bright red “Apply” button – you can’t miss it. Click on it, and the next step of the process begins. Here you will input all your particulars and activate the loan if a lender can assist you – but we will get to all the application steps a little further on! For now, let’s take a closer look at the types of personal installment loans you can get your hands on in the US.

Types of Personal Installment Loans Near Me

Everyone is unique and much the same; there are several unique options to choose from when it comes to personal installment loans online. For example, there are personal installment loans for bad credit, unsecured personal installment loans, no credit check personal installment loans* and more! Below is a list of the types of personal installment loans you can access online:

Personal Installment Loans for Bad Credit

Borrowers with bad credit in the past are often hesitant to apply for personal installment loans. Some bad credit personal installment loans are designed for credit building, and if you’re set on applying for a small amount that you can quickly and easily repay, you can do precisely that. But, of course, if you’re in a bad financial position, have an incredibly low credit score, and your situation hasn’t changed, it’s not a wise idea to apply for a loan. You should only apply for a loan if you can comfortably afford the expected monthly installments. Lenders on the Heart Paydays panel may carry out a credit check and also verify other eligibility criteria before granting personal installment loans bad credit. One crucial qualifying factor is how much you earn. You need to be making at least $1000 per month and be comfortably affording your current monthly expenses before you can apply for bad credit personal installment loans.

Personal Installment Loans No Credit Check*

Credit scores have been holding the average American hostage for years. If you happen to have a rocky financial past, you may fear that a credit check will put you out of the running for financial aid when you need it most or whenever you try to apply for personal installment loans bad credit. While Heart Paydays doesn’t carry out a credit check on applicants, the lenders offering finance may do so. They also check several other things to get a well-rounded picture of the borrower. For instance, your credit score alone isn’t the only determining factor. If you have an excellent credit score, for example, apply for online personal installment loans. Still, your income vs. expenses shows that you won’t be able to afford the monthly installments; you may not get the personal installment loans no credit check you’re after.

Things that are considered include your income, your current monthly expenses, and your citizenship/residency status in the US when you apply for *no credit check personal installment loans. Loans via the Heart Paydays site range from $100 to $5000, so there’s a loan amount for all borrowers with various budget restraints. And, of course, all credit scores are welcome to apply – the lenders will make the final decision in the end if they can assist or not. All loans come with flexible repayment terms. What this means is that the lender will discuss the best payment schedules with you, which usually ranges from 3 to 24 months depending on how big the no credit check personal installment loans are that you’re applying for.

Unsecured Personal Installment Loans

Unless you’re putting up some collateral, such as a house, vehicle, jewelry, or some other asset, you’re taking out an unsecured personal loan. Unsecured personal installment loans don’t require collateral and also don’t require a co-signatory to secure. Of course, if you’re opting for a secured loan, it’s easier to achieve, as collateral and co-signatory make the loan less risky for the lender. When searching for unsecured personal installment loans on the Heart Paydays website, you will be given access to lenders who provide unsecured loans to qualifying applicants. These loans range in size from $100 to $5000 with 3 to 24 months to pay. Unsecured personal installment loans are risky for the lender because there’s no guarantee that borrowers will pay the installments as promised. In return for the risk, the borrower faces a high-interest rate and the risk of having their credit record tarnished if the loan isn’t paid back as specified. Of course, when applying for a loan with Heart Paydays, the lender will assess the application to ensure that you’re able to afford the loan. In addition, they will discuss the best repayment schedule with you and determine whether you’re a good candidate for a loan.

Personal Installment Loans Near Me

In the past, you might have had to go to a storefront or a local bank to apply for personal installment loans. Nowadays, with digital advancement, there’s no need to leave the comfort of your home or office to get the cash you need. A simple search for “personal installment loans near me” will undoubtedly point you in the direction of Heart Paydays. Heartpaydays.com is not a direct lender but can put you in touch with lenders and brokers in the US with personal installment loans designed for every kind of borrower. At Heart Paydays, you can apply just once for a loan, and your request will be automatically connected with lenders most likely to assist you. Loans range from $100 to $5000 with the convenience of 3 to 24 months to pay. What’s more is that when you apply, you’re not obligated to go ahead with any of the deals offered. You can opt out if you feel none of the loan deals are suitable for you and your current financial situation. Finally, pay attention to interest rates. Typically, they range from 5.99% to 35.99%, but most lenders will try to be competitive, so it’s always best to ask for a lower interest rate – it’s worth a try!

*Disclaimer: Whilst Heart Paydays doesn’t check your credit, your credit may be checked by one or more of our lending partners and their third party credit bureau’s upon submission of your request, or at a later date. Further information can be found in our terms and conditions.

The operator of this website does not make any credit decisions. Independent, participating lenders that you might be matched with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit.

Features Of Personal Online Loans With Installment Payments

Most personal online loans with installment payments via Heartpaydays.com share similar features as mentioned below. Although, it is best to keep in mind that all lenders have their own set of features, terms, and conditions.

100% Online Application

It’s easier than ever to apply for installment loans for bad credit because there’s no need to leave your home or office. Instead, you need a device that connects to the internet and your details. You can use a laptop, mobile phone, iPad, or desktop computer to complete the online application form. The final loan agreement can even be signed digitally and the cash sent directly to your bank account.

Get Cash After Just A Few Hours

Who says you have to wait days for personal installment loans to be paid out? When applying for installment personal loans, you can expect the entire process, from initial application to payout, to take just a few hours. While this cannot be 100% guaranteed, as sometimes there can be delays, most lenders aim to pay out their loans within 24 hours of approving them. In many instances, the payout even happens as soon as just one hour after approval.

Interest Ranging From 5.99% to 35.99%

Lenders represented on the Heartpaydays.com site keep it tidy when it comes to interest. Most try be as competitive as possible with interest rates, which means you can see rates as low as 5.99%. Others will be less competitive and push their rates to the max, which is usually around 35.99%.

Examples of Personal Loans Installment

Before applying for personal installment loans, you might want to determine if it’s worth your while. By taking a look at some examples of personal installment loans, you can decide if they’re the right finance option for you. Here’s a sneak peek at some loan options available through Heart Paydays.

| Lender Name | Loanable Amount | Loan Term | Interest Rate or APR |

| OppLoans | $500 – $4,000 | 9 to 18 months | Varies with the combination of loan amount and term |

| GreenDay Online | $100 – $5,000 | 24 months | Depends on chosen loan amount |

These are just examples and are subject to change.

Advantages And Disadvantages Of Personal Online Loans With Installment Repayments

The following advantages and disadvantages can be expected when it comes to personal loans installment options:

Advantages Of Personal Installment Loans

Same Day Payout

There’s a lot to be said about the utter convenience and relief experienced when you apply for a loan, you need the cash in a hurry, and the lender does what they can to ensure that the loan is paid out as quickly as possible after approval is received. At Heart Paydays, the lenders are dedicated to quick turnarounds on loan applications and disbursements that are just as quick. While many of the loans approved are paid out within 60 minutes, it’s expected that if your loan is approved, it will be paid into your account by the next business day.

Total Discretion

The beauty of applying for personal installment loans online is that there’s no need to worry about anyone finding out about your financial position or the fact that you might be applying for personal installment loans for bad credit. All your data is kept discreet, and you won’t bump into anyone you know in the queue because there is no queue! The entire process is handled online, so if you’re loan application is rejected for some reason, nobody even has to know. Total discretion is guaranteed, which can go a long way if you’re anxious about your financial position or don’t like to share such personal information with people you know.

Reasonable Income Requirement

You don’t have to be earning the big bucks to be eligible for personal installment loans. In fact, you only need to have a regular income of $1000 per month in order to qualify for a loan. Of course, earning an income is important, but that doesn’t even mean that you have to be employed in the traditional sense. You can earn your income from means other than an employer. For instance, your freelance income, rental income, or even dividends from your investments can be used to prove that you earn sufficient money to apply for a loan.

Disadvantages Of Installment Personal Loans

Not The Cheapest Form Of Borrowing

The convenience of same day and personal installment loans for bad credit isn’t free – it comes at a cost. Personal installment loans are typically expensive because there’s an increased risk to the lender. This means you can pay interest of between 5.99% and 35.99%, which can become costly in the long run, depending on the term of your loan and how much you choose to borrow too.

Eligibility Criteria for Personal Installment Loans with Bad Credit

While it’s simple and reasonably quick to apply for personal installment loans and personal installment loans with bad credit, it is important to meet the eligibility criteria. While lenders have their own set of criteria, the most common criteria to meet are as follows:

- You must be at least 18 years of age to apply for a loan.

- You may not apply for a loan with Heart Paydays if you are not a US citizen or don’t have legal permission to reside in the US.

- In order to be eligible, you must present a valid form of ID.

- Proof of address is required to process applications for personal installment loans.

- The minimum earning for applicants is set at $1000 per month.

- You must prove your income by providing 3 of your last pay slips and 3 of your last bank statements.

- You must have an active US bank account and mobile number that you can be reached on.

The Quick & Easy Application Process For Online Personal Installment Loans

Applying for installment personal loans online is considered a quick and easy process. And it is especially simple if you’re using the Heart Paydays loan-finder service. Here you can apply just once for a loan and automatically get linked with lenders who can help you financially. Below are 4 simple steps you can follow to apply for online personal installment loans.

Step 1: Determine How Much You Need

Many borrowers don’t realize it, but this is one of the most important steps when looking for a lender. This is because if you overshoot the loan amount required, you could find your loan being rejected on the basis that it is ill-affordable on your current budget. Take some time to consider your monthly income and expenses and be realistic about what you can afford. Never request personal installment loans that you will find difficult to repay. Once you’ve decided what you need to loan, you should also select the loan term (this is the period of time you wish to repay the loan over). When using Heartpaydays.com, you will be able to choose between loans of $100 to $5000 with 3 to 24 months to pay.

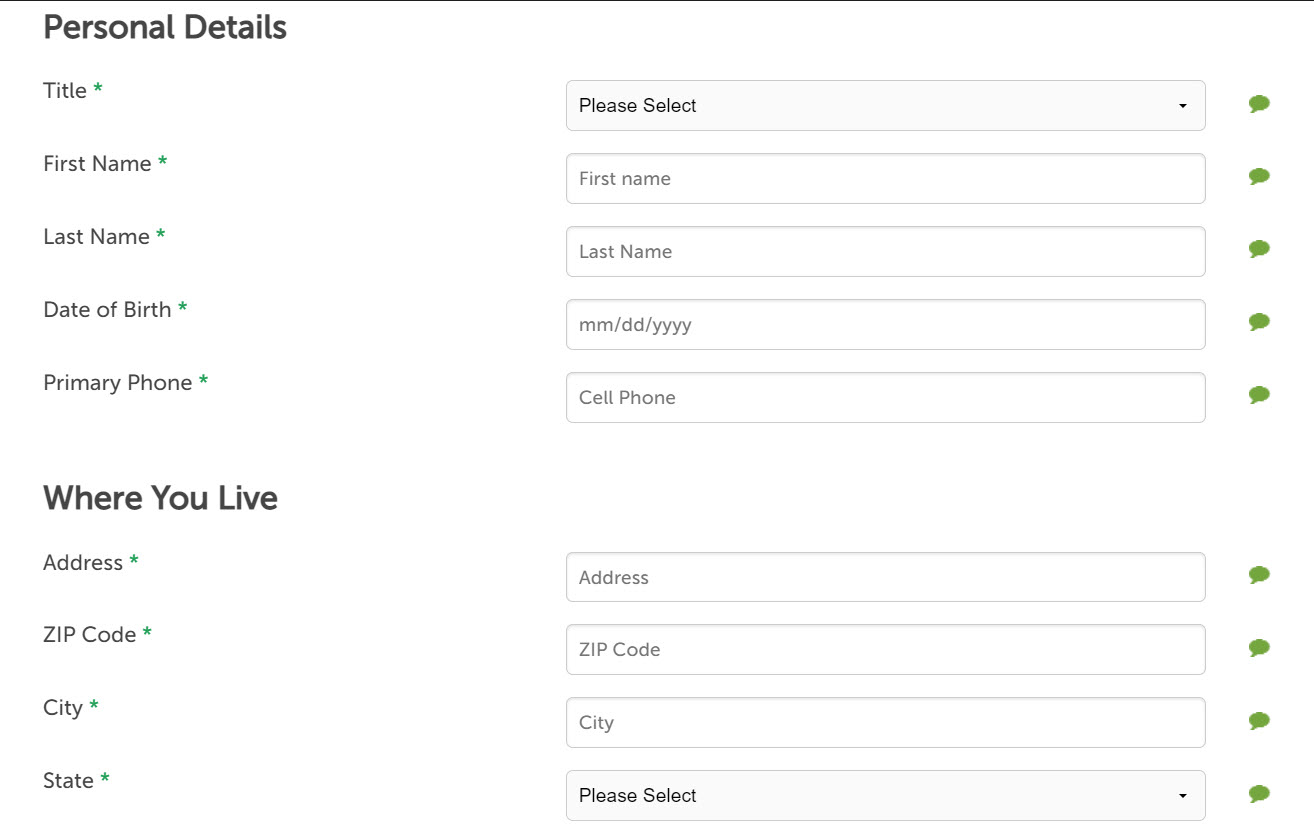

Step 2: Get Your Details Uploaded

While you don’t have to fill out a physical application form, you do have to complete an online form with your particulars. This will ensure that the lender has everything they need to consider your application for unsecured personal installment loans. Simply look at the top right-hand corner of your screen, and you will see a bright red “Apply” button. Click on the button and simply follow the prompts, filling in the requested information as you go. Heart Paydays will not share your details with additional parties. Details that will be requested are your full name, ID, address and contact details, employer particulars, banking details (this is to ensure the money is paid into your account and to set up the direct monthly installment debit), and a list of your current expenses. Be as accurate as possible as lenders will take the time to verify the information provided. When you’re ready, and happy that the information is correct, simply hit the “Submit” button.

Step 3: Wait Two Minutes For An Outcome

Nobody likes to wait, and lenders figured this out a long time ago! The system is, of course, automated, which saves a lot of time and effort. It takes just two minutes to approve (or reject) a loan application. These approvals are, of course, subject to further checks by the lender. If you choose to go ahead with one of the loan offers, you will be put in touch with the lender offering personal installment loans. At this stage, they may request further supporting documentation. Finally, if all is in order, the loan agreement will be sent to you for review.

Step 4: Review The Loan Agreement, Sign It, Get Your Cash!

While the idea of your loan being approved may be exciting, you should avoid the temptation to sign the agreement quickly. Instead, make sure that you read through the terms of the loan and if you’re not 100% sure of anything or there are confusing terms, make sure that you ask the lender for further clarification. When you are happy, you can sign the loan digitally and send it back to the lender. Once it’s been checked over one more time, the online personal installment loans provider will finalize the loan agreement. And that means you get the cash paid into your bank account! The good news is that while most lenders promise a next-day payout, many loans are paid in as little as just 60 minutes. All that’s left to do is put the cash to good use!

FAQ’s

Are Personal Installment Loans Online Secured Or Unsecured?

It really comes down to the type of loan you apply for. Personal loans installment based can be secured or unsecured. If you aren’t required to provide collateral or co-signatory, then the loan is unsecured.

What Are The Most Common Types Of Personal Installment Loans?

The most common installment loans are same day loans, unsecured personal loans, secured personal loans, auto loans, mortgages, and bad credit loans, to name a few.

What Does My Salary Need To Be If I Want To Apply For Personal Installment Loans Near Me?

The minimum earning requirement is $1000 per month.

How Long Does It Take To Get Approved For Personal Online Loans With Installment Payments?

Most online lenders will provide you with feedback on your loan application in as little as just two minutes. The application itself also only takes a few minutes.

What Do You Need For An Installment Loan?

When applying for personal installment loans, you will need to provide your social security number, ID, personal banking information, bank statements, and proof of address.

Are Personal Loans Installment Or Revolving?

Many first-time borrowers want to know, “are personal loans installment or revolving loans?” and the simple answer is that they are not. Installment loans and revolving loans are two different things. Installment loans have fixed payments and a designated end date, whereas revolving accounts are more like credit cards where you can keep using the account month to month with no determined end date.

*Disclaimer: Whilst Heart Paydays doesn’t check your credit, your credit may be checked by 1 or more of our lending partners and their third party credit bureau’s upon submission of your request, or at a later date. Further information can be found in our terms and conditions.

The operator of this website does not make any credit decisions. Independent, participating lenders that you might be matched with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit.