Many people experience fund shortages when it comes to budgeting. There are numerous reasons why individuals find themselves in a very sticky financial situation, where they struggle to pay daily expenses and suffer from a lack of security. Luckily, many financial products are available for these individuals, giving them a chance to access a line of credit, even if their credit score or credit history doesn’t permit them. Easy approval installment loans for bad credit from direct lenders allow credit-challenged individuals to navigate out of their current financial woes.

What are Easy Approval Installment Loans for Bad Credit & How Do They Work?

Guaranteed installment loans for bad credit refer to special installment loans which are designed for credit-challenged individuals. It is a type of loan which allows the borrower to borrow a pre-set amount with favorable repayment terms. The only difference between normal installment loans from traditional financial institutions and bad credit installment loans is that the latter is granted to individuals who would not be eligible for installment loans elsewhere. These individuals often have below-par credit scores and bad credit history which seriously limit their credit-taking capabilities. Bad credit installment loan lenders thus grant these loans to such individuals, providing them fair access to lines of credit, albeit with some higher interest rates.

Guaranteed installment loans for bad credit can be accessed from a variety of sources thanks to a range of options available online. Many borrowers prefer guaranteed installment loans for bad credit from direct lenders simply because they either have a past working relationship with them, or all the terms of the loans are favorable to them. Alternatively, they can sign up with loan brokers which work with numerous lenders to provide their applicant with the best chances of accessing credits. One such example is Heart Paydays, which works with numerous lenders with APRs ranging from 5.99% to 35.99%.

Easy Approval Installment Loans for Bad Credit Mississippi

In the United States, Mississippi is one of the most impoverished states in the country which is why installment loans for bad credit and other related financial products are in great demand. Despite multiple attempts by Mississippi regulators to impose more restrictions, these forms of loans are still readily available in the State.

Many brokers and lenders including Heartpaydays.com offer borrowers in Mississippi the chance to access credit on an emergency basis, even if their credit scores are low. These loans usually come with high-interest rates and other fees.

Features of Easy Approval Installment Loans for Bad Credit

Online Installment Loans with Instant Approval for Bad Credit are personal installment loans for credit-challenged individuals with either bad credit history or low credit scores. The loans can help individuals tackle tough economic circumstances such as bankruptcy, repossessions, foreclosure, and others. Many individuals also take out these loans for establishing a better credit history or to consolidate debt. Examining the features of bad credit installment loans will help borrowers make well-informed decisions.

- Interest rates

Bad credit installment loans carry with them higher interest rates compared to normal installment loans. This is due to the fact that the lender is taking in more risk when providing loans to individuals with questionable creditworthiness. In spite of this, it is still possible to find guaranteed installment loans for bad credit from direct lenders with reasonable interest rates if one does some research. This is also one of the reasons many borrowers opt for lending brokers that can expand their options and increase their chances of finding favorable loan terms.

- Payment terms

Payment terms of installment loans for bad credit can vary from lender to lender. Borrowers must ask themselves some pertinent questions before taking out the loan. They should be sure about the amount of loan they need, whether they can pay the loan back on time, and the amount of cash they can pay lenders per month.

- Easy Applications

Most online brokers and lenders that offer installment loans usually provide easy application procedures which help the applicant understand the loan terms in a clear and transparent manner. Most lenders provide an online application that requires the borrower’s personal information such as bank details, mobile number, and valid email address. Most loans are approved within one to 3 days depending on the broker or lender.

Charges and Penalties for Easy Approval Installment Loans for Bad Credit

Most lenders and brokers of installment loans charge high-interest payments which can be evaluated from their APR. The APR or Annual Percentage Rate is what lenders charge borrowers for the loans. All loan products must clearly specify their APR so that borrowers can compare them correctly. At Heartpaydays.com, borrowers can get loans from lenders with APRs ranging from 5.99% to 35.99%.

Some of the other fees associated with bad credit installment lenders include loan origination fees, application processing fees, and late payment fees. Late payment fees can seriously hamper one’s ability to pay back the loan on time as the payable amount can accrue beyond one’s control.

Eligibility Criteria for the Easy Approval Installment Loans for Bad Credit in the USA

Installment loans for bad credit and other similar financial products have been designed to aid individuals with a low credit rating or history. Naturally, these lenders do not impose rigid conditions on the loans, although interest rates are higher. While the requirements for loan approvals can differ from lender to lender, individuals usually have to submit the details about their identity and income sources while applying.

In the case of Heartpaydays.com which is a reliable lending broker in the US, applying for installment loans is easy and requires the following:

- The borrower must be a valid US bank account holder

- He/she should have a valid email address and registered phone number.

- The individual applying for the loan should be 18 years or older.

How to Apply for Easy Approval Installment Loans for Bad Credit in Quick Steps

Individuals with bad credit can apply for loans at Heartpaydays.com which works with a collection of lenders to provide their clients with the best loan terms available. Signing up with Heartpaydays.com and applying for a loan is seamless as illustrated in the following steps below.

Step 1: Selecting the loan amount

At heartpaydays.com, the application form will first ask the borrower to specify their loan amount. They should be absolutely precise with the requested loan amount before submitting it. The broker allows applicants to apply for loans up to $5000.

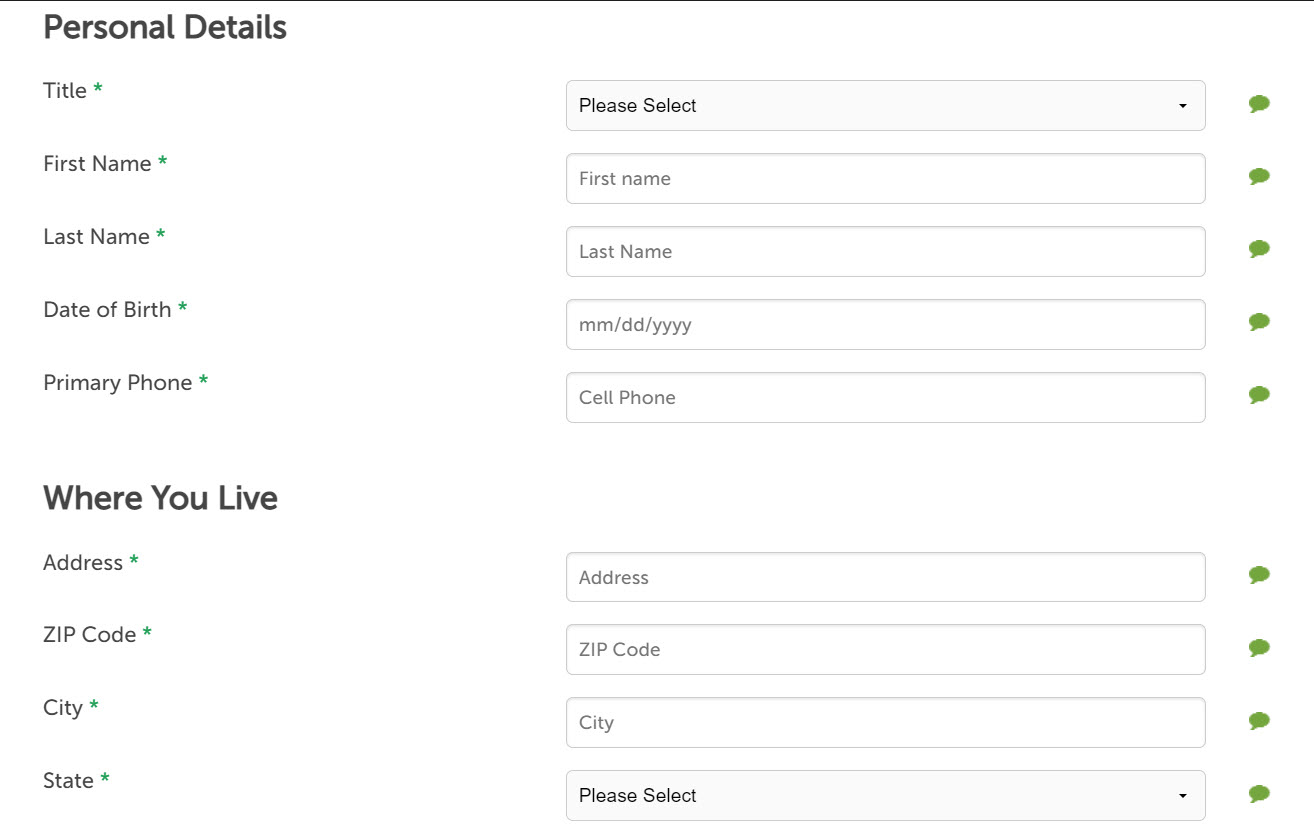

Step 2: Completing the loan application form

Heartpaydays.com offers a very short and easy form that simply asks borrowers to specify their loan amount and their preferred terms and conditions.

Step 3: Waiting for approval

Heartpaydays.com reviews the loan application after the borrowers submit it. Borrowers should note that heartpaydays.com doesn’t carry out any credit checks directly. Instead, its lending partners may evaluate an individual’s creditworthiness with the help of an external; credit scoring service.

Step 4: The loan amount gets credited to the borrower’s account

Lastly, after the lender has completed security and verification checks, the borrower will be notified about the approval of the installment loan. The loan amount may be credited within the same day or up to 5 days depending on the broker selected.

How to Find the Easy Approval Installment Loans for Bad Credit in the USA?

Borrowers will find numerous lenders offering installment loans but not all of them are legitimate. This is why they should always conduct research into the lender’s background before applying it. Many lenders prey on unsuspecting clients, burdening them with hidden fees, changing high-interest rates, and other ambiguous terms and conditions.

This is why it is advised to always choose a lending broker like heartpaydays.com to increase one’s chances of getting a loan applied with favorable terms and conditions. They will not be at the mercy of a single lender’s whims and fancies and can choose from a wide range of lenders providing different terms and conditions. It also saves time for the borrower by not having to apply with different lenders individually.

Conclusion

High-interest rates normally deter a borrower from getting a short-term loan. However, for credit-challenged individuals who are out of options, getting an installment loan may be the only way out. While most lenders don’t trust individuals with a questionable credit score, heartpaydays.com is one such broker that can offer these individuals fair access to a line of credit. It provides a comprehensive platform from which applicants can compare options and get favorable loan terms that would otherwise not be possible.

FAQs

How to get a bad credit loan?

US citizens can apply for bad credit installment loans from a variety of lenders and brokers. Most brokers offer simple terms which allow any credit-challenged individual to get instant financial relief. Most brokers and lenders require the applicant to be over 18 years of age and the holder of a valid bank account. Borrowers can get guaranteed installment loans from direct lenders as well as brokers.

How Can I Apply with Loan Providers That Will Not Perform a Credit Check?

There are a number of lenders that provide installment loans to individuals without the need to perform a credit check. Some of these loans can be collateralized with an asset such as a car or a house. There are other lenders that provide unsecured installment loans which carry high rates of interest and other associated fees. To make sure that the lender or broker doesn’t perform credit checks; borrowers must research the terms and conditions in detail before applying.

How Long Does Heartpaydays Take to Approve a Loan Application?

Heartpaydays.com works with some of the fastest lenders that usually credit the requested loan amount within the same day. However, the borrower’s bank may or may not support fast payment methods which can delay the process.

How Much Money Can I Borrow under Bad Credit?

The maximum amount that a borrower can take out as an installment loan depends on the lender and the laws related to installment loans. In the case of Heartpaydays.com, applicants can request loans ranging from $100 to $5000.

Are installment loans secured or unsecured?

Installment loans can come in both secured and unsecured forms. Secured installment loans usually require the borrower to put down an asset to guarantee against the loan. This usually comes in the form of mortgages or business loans. On the other hand, personal installment loans for bad credit are usually unsecured loans as these loans do not require any asset from the borrower.

How Can I Apply For Bad Credit Loans?

One can apply for bad credit loans from a variety of different lenders and brokers available in the market. It is always advised to search for bad credit loans with an online broker as the chances of getting favorable terms increase by many folds.

Is a bad credit loan right for me?

Individuals who find themselves with a low credit score often struggle to access credit from traditional institutions. This can lead to stress as delayed payments can hamper one’s quality of life. Taking out an installment loan to ease this stress may be the only way out for some individuals. Some of the most common reasons for taking out installment loans include debt consolidation, meeting emergency medical payments or expenses related to sudden car problems.

How do installment loans affect your credit?

As long as the borrower is paying the loan installments on time, his/her credit score won’t be affected. Taking out an installment loan can also help diversify a borrower’s portfolio of loans. A person’s credit history gets positively affected if there are different types of loans. This ensures credit bureaus that the individual in question has the capacity to pay back loans on time. However, failure to make a loan payment or paying the installment 30 days late can negatively affect one’s credit score. As payment history accounts for almost thirty-five percent of an individual’s credit score, making late payments to lenders can have disastrous consequences.